8 Tips for lowering your DSO

Want to lower your DSO?

For many credit managers, lowering your DSO (day sales outstanding) is a key KPI, and for good reason. Collecting invoices and recovering payments as quickly as possible greatly improves the cash flow of the business.

So, if you’ve been assigned this important task just what exactly can you do to improve and lower your DSO?

1. Improve your credit approval process

As part of the process of on-boarding a new customer or business partner, a full financial search should be conducted. But in these modern times, there are also other avenues you can use to research into a company. Check the creditworthiness of your potential customer by requesting a credit report, research their website, check their social media accounts and google search them. Are they who they say they are? Do they have a proper address and business location? Is there bank a reputable one? Has there been any negative press about them? Have you verified their billing addresses and accounts email addresses?

If you find any red flags or warning signs, you can put measures in place to protect your company.

2. Offer multiple payment methods

By providing the customer with a range of payment methods such as credit cards, cheques, bank transfers, direct debits or online payments, you make the payment process easier for your customer. This removes any issue the customer may have about how to pay.

3. Make it easy for your customers to communicate with you

Communication is the key to everything but it’s one of the hardest things to get right. Provide multiple channels for your customer to reach you should they need to. Adopt online comms such as chat bots, e-mail and direct messaging but also provide the customer with one, main point of contact they can reach out to.

4. Clear, concise invoices

You can’t expect your customer to pay on time if you don’t send out your invoices in a timely manner. Nor if they are incorrect in any way. Avoid issues with payment by ensuring your invoices have the correct information on them and payment terms and dates are clear.

5. Invoice management

Once an invoice has been sent out, it’s not out of your hands. As part of your invoice management procedure, set up payment reminder notifications for you and your customer. Chase late payments immediately so it is clear to your customer that you are to be taken seriously. Is there a dispute about a product or service delivered? Make sure you’re aware of this and follow up accordingly. Any dispute will likely result in late or non-payment.

6. Outline your collection process

Should an invoice become overdue, have a clear collection policy in place. This should also be part of the contract so that your customer is aware of what happens should an invoice not be paid on time.

Make sure your accounts receivable or credit management team have the training and resources to collect an invoice. Not only that, but when it comes to collecting international invoices, knowledge of business culture is most important. For example, in some countries you will be more successful collecting debt by calling than sending a written reminder or vice versa.

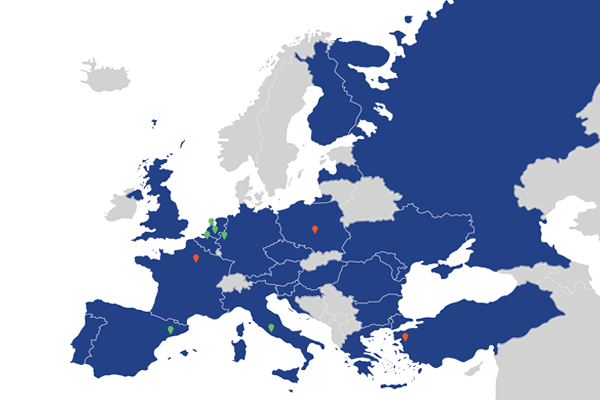

If you don’t have the resources internally, engage the services of a debt collection agency or law firm. At Bierens, we have more than 65 years’ experience collecting debt and if our extra-judicial methods are unsuccessful or if you have a disputed invoice, we can litigate on your behalf.

7. Motivate your customers to pay

Most payment terms are set and agreed on 30 days. Whilst this shouldn’t necessarily be reduced or extended there are other ways you can motivate your customer to pay quicker. For example, offering incentives such as a discount if they pay within the first 10 days of the invoice date.

8. Regularly analyse your customers

It is important to measure the performance of a customer. Customers are generally measured on sales in companies, but their financial performance should also be tracked and measured. Has your customer started to pay later? Do they consistently pay late? Who are the repeat offenders and why? Once you understand the reasons, you may be able to put stricter processes in place. Or for those repeat offenders, you may want to consider ending the relationship entirely. Saying goodbye to a customer may seem wrong but if they are significantly and negatively affecting your DSO, you may be better off in the long run.

More information about lowering your DSO

If you would like more information about improving and lowering your DSO or have unpaid invoices, then get in touch with us today. Our team of collection specialists and lawyers are experts in collecting debt internationally.